Risk Interconnectivity

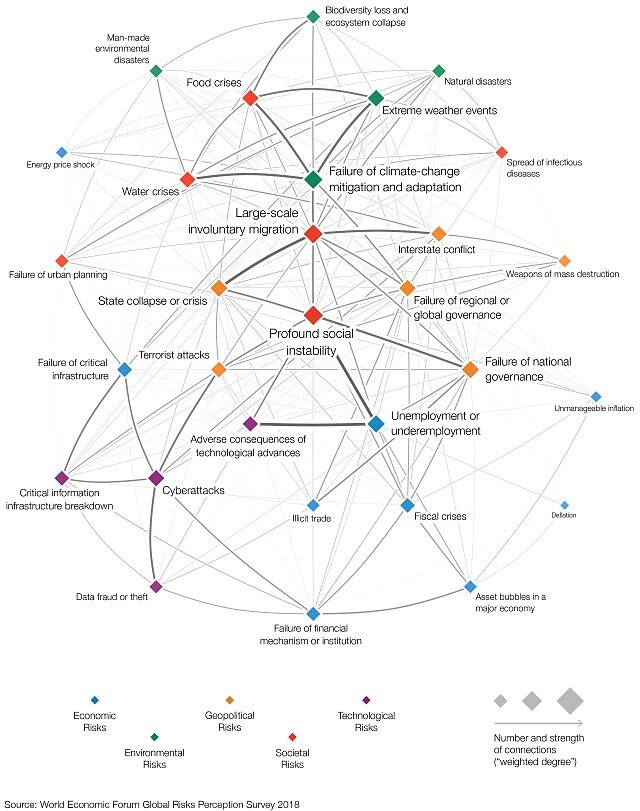

Risk interconnectivity is, if you ask me, the original reason for ERM’s existence; organizations were supposed to have an “integrated risk management” so that they could understand the portfolio of risks, get a sense for the amount of total risk (“easier” in insurance), “abandon silos”, identify natural hedges, think about mutually amplifying risks, and consider the correlations/connections between risks. This of course is an extremely difficult task. So many risks are linked and then to try to put a number on the connections in some way - better we just move on to something else like governance and structure of risk management or trying to be strategic, right? I’m not so sure! Just because something is hard doesn’t mean we can ignore it. In fact, if we ignore the hardest parts aren’t we probably missing an important aspect of where we as an ERM organization could add value?

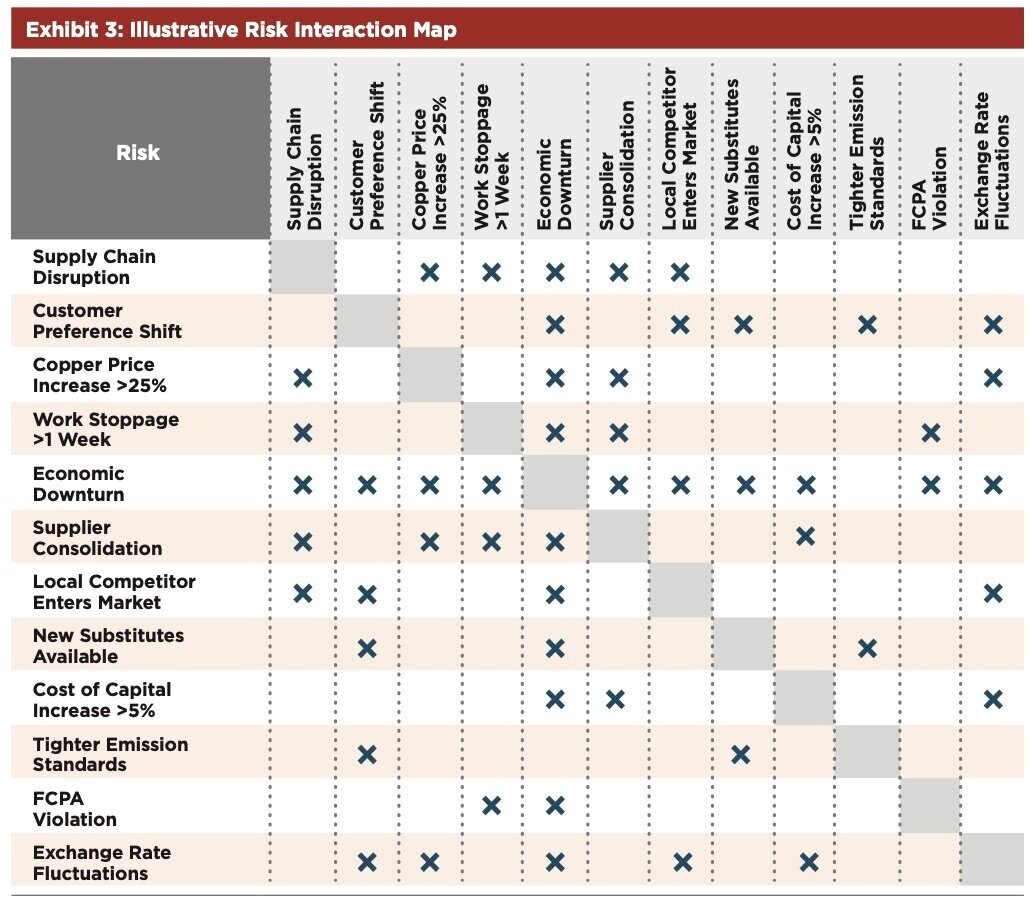

This rant was sponsored by the skepticism during a workshop in terms of identifying interconnectivity between risks. How much effort should we put here? How should we do it? Numbers are impossible to calculate here! (says the gentlemen from the insurance industry who calculates VaR every day). The answer to many of these questions from my end is: I don’t know. But I do think that not trying is dangerous. Here are some suggestions for how this can be accomplished at least as a first step: